The one thing that every business has in common is that it has to produce accounts and file a tax return to meet its legal obligations. And, of course, pay any tax due on the profit from the business.

Some, with the most straight forward accounting, try to meet their regulatory obligations themselves whilst many others, particularly those operating via a Limited Company, reach out to an accountant to help them. Of course, that comes at a fee and in these difficult times funds may not stretch to that outlay.

Just how easy is it to do business accounting yourself?

Like many other industries, the world of accounting is changing enormously thanks to technology which makes it much easier to do the accounts yourself and take control of your business finances. The technology solutions available will organise your business transactions, do the accounting “maths” for you, give you key insights into the performance of your business, provide reports for monitoring and even help you to file everything with the necessary authorities at the end of the year.

The result is a move away from such a heavy reliance on bookkeepers and accountants with much of the leg work being done by technology.

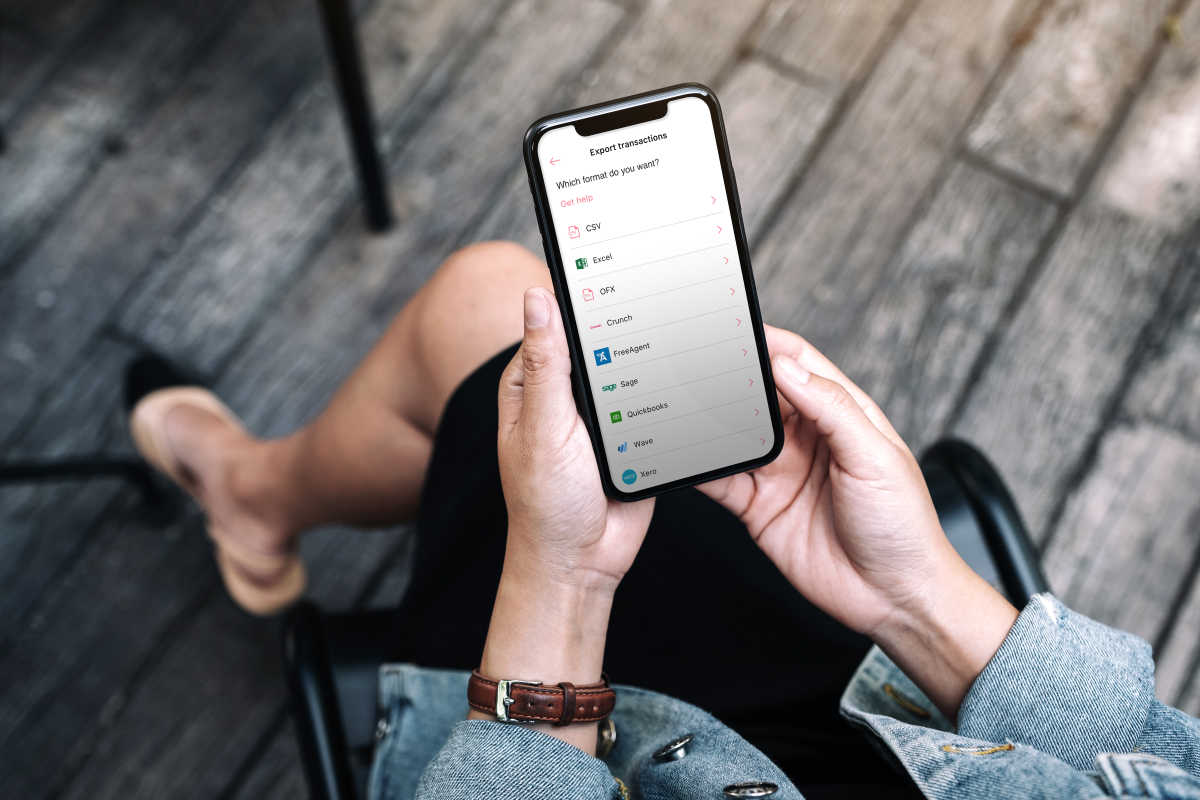

For those with very simple and straight forward accounting needs, there are Challenger Banking Apps which promote a new way of working combining banking and accounting all in one place. By raising customer invoices and using a Banking Card to pay for things, all of the business transactions are captured and categorised to account headings within the app meaning that the bookkeeping is pretty much done for you.

The app produces a summary of transactions which is certainly sufficient to use for a self-employed, self-assessment tax return although a little more formatting and structure is required to meet the obligations for a Limited Company. A dashboard highlights your key figures, such as turnover (the word used to describe business income) and profit as well as giving you an estimate of how much tax would be due allowing you to set aside that amount in a Tax Pot.

A Tax Pot is a separate account where you would transfer funds equivalent to your estimated tax bill based on your profit for the year. Using Tax Pots is the right way to run your finances and avoid the temptation to spend the money that you owe to HMRC (Her Majesty's Revenue and Customs).

The term Challenger Bank was first introduced to describe a wave of new banks set up in competition to the traditional high street banks, although the very banks that this entrepreneurial group of companies set out to disrupt do have their own offering such as Mettle the business account by NatWest which gives you the backup of a major institution with the new technology on offer.

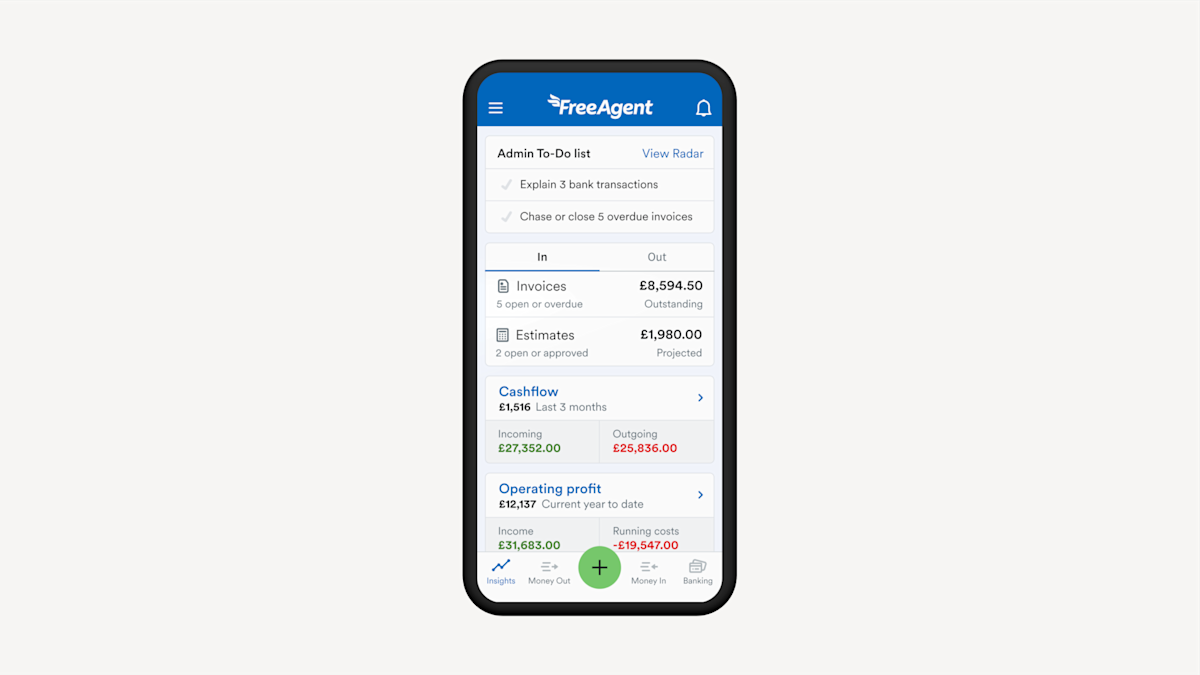

If a Banking App isn’t your thing then using a Cloud Accounting System is a great alternative. Cloud Accounting has been around for well over 10 years now with function-rich solutions, such as FreeAgent, offering easy to use technology that makes keeping the books a doddle.

The starting place with a Cloud Accounting system is to link it up with your business account; there’s usually a tutorial provided to show you how to do this. This link-up will automatically drag the banking transactions into your cloud accounting system. From there you simply explain more about the transaction so that it can be posted to the correct place in your accounts. Accountants call this bookkeeping but Cloud Accounting systems make this a lot less scary than the title would imply.

Logically if you pay for everything for your business and receive all business income into your business account then, via the link-up, you’ll have all your bookkeeping done.

Like the banking apps, your Cloud Accounting system would also have a dashboard highlighting your key business performance metrics such as turnover, profit and your estimated tax bill to use to set aside money into your Tax Pot.

There’s no right or wrong answer to what system to use. Like buying a new laptop, TV or even a pair of jeans, sometimes you just have to plump for the one that looks and feels right for you and what you need to do.

As we move towards an era of HMRC’s flagship Making Tax Digital regime there will be no excuse for not having an accounting system of some sort and keeping your books up to date. Under the new regime, the next stage of which is being introduced starting from April 2023, quarterly electronic reporting of self-assessment (personal) tax information to HMRC will be compulsory for almost all people. HMRC have yet to publish the full details of what they will require and when. Whatever they ask for will be no cause for concern if your business finances are well managed – the data will all be there and the systems provider will be the one doing the development work to link it through to HMRC.

Basically, you’ve got just less than two years to get organised and that should be plenty of time for anyone, assuming you avoid leaving things to the very last minute!

What does this mean for accountants and bookkeepers?

Of course, they will still be needed as that safe pair of hands; the expert on call when you get stuck or when you need to be kept up to date with important changes. Or perhaps when your business is so busy you can outsource some of the work to a bookkeeper or an accountant leaving you to focus on the business rather than financial operations.

The key is to know when you need them, what you need them to do and how much it should cost you. Using a system empowers you to make these decisions and get value for money from the support that you may need.

All this sounds ideal but what are the next steps to making it happen?

The first thing to do is to go for your systems solution of choice.

Start using that immediately for all business transactions, including paying for all costs from the business account and getting customers to pay your invoices directly into the business account.

If you’re partway through your current year you may need to add in the transactions to date. You can do this by way of an adjustment (called a journal) in a Cloud Accounting system. For a Banking app, you may need to manually combine the transactions to date when you prepare your year-end figures.

Check your dashboard regularly and make sure that you are transferring funds to your Tax Pot at least on a monthly basis.

If you get stuck then ask an accountant to help you to get this set up allowing you to take things over once the starting position is sorted out.

Remember that accounting is really simple – it’s a bit of adding up your income taking away your costs to work out your profit upon which a percentage tax rate is applied - and systems can do it all for you.

What’s complicated in that?

This blog was written by one of our accounting partners, therefore the opinions and information expressed in this article are entirely that of Cheap Accounting.