In this blog, we look at some of things you need to consider when starting a small business – from setting up as a sole trader versus a limited company to working with an accountant and finding the right bank account.

Although we’re focusing on sole trader and limited company structures here, there are other ways to form your business. For instance, you could set up a social enterprise or partnership, which can be with or without limited liability.

Private limited company vs sole trader

Key differences between a limited company and sole traders

Private limited company

To set up a private limited company, you’ll need to register with Companies House. You can do this directly on their website, through your accountant or an online company formation agent.

It’s a quick process where you’ll be asked a few basic questions. These mainly include your business name, address, industry, who the company directors, secretaries and shareholders are, as well as people who hold significant control of the business.

This is generally the process to incorporate a company.

The main benefit of a limited company is that you’re only liable for the money you put into the business – not your personal finances. So if the worst were to happen, where your business couldn’t afford to pay the bills or was sued, the company would be sued – not you as an owner.

A word of caution though, if you, as a director, give a personal guarantee on a business loan, you won’t be covered for this.

There are, however, tax considerations when forming a private limited company. Rather than the tax you pay personally through your self assessment you’re taxed on the drawings you take from the business, with dividends being taxed differently to your salary.

The downside to this type of structure is that there are a number of filing requirements, such as company accounts as well as your tax returns that you have to do. You can get help with these from an accountant, although it’s possible to do them yourself, or with the support of accounting software, particularly if your business has very few incoming and outgoing transactions.

Sole trader

Operating as a sole trader means you’re self-employed and don’t need to formally incorporate a business like you do for private limited companies.

This means that the profits that your business earns is your personal income, and taxed at income tax rates. However, with this structure, you’re personally responsible for any losses the business makes. The concept of ‘limited liability’ doesn’t exist.

Most people who are self-employed are required to register for a self-assessment and file a personal tax return each year. In terms of naming a sole trader, you can use your own name, or choose another name – the government provides guidance on what to avoid and what to consider.

The main benefit of setting up as a sole trader is that it’s probably the simplest to do, with very little paperwork when setting up, but also a lot less throughout and at the end of the year.

Another benefit is you can use this structure to test things out. For instance, if your business is new and you’re not ready to fully-commit, a sole trader structure gives you the flexibility to stop at any time without the need to formally close down the company or do additional paperwork.

Many businesses use this as a stepping stone, and when they’re ready, they move to a private limited company.

A key challenge that you’ll face is being able to separate your personal and your business’ money. Quite often, business owners use the same bank account for both, so putting money aside for payments like tax can be confusing.

In any case, for a sole trader or private limited company we’d suggest using a separate business account as this can help manage your money and be easier to understand how your business is doing on a day-to-day basis.

In any set-up, you’ll need to keep effective records of your business’ income and expenses. It’s required to remain HMRC compliant and calculating your tax returns. For more information check out Our Beginner’s Guide to Bookkeeping.

It’s worth also noting that if you expect to turnover more than £85,000 a year, you’ll also need to register for VAT, which you will have to add onto all of your sales – but can claim back on your expenses. Different schemes apply so you might want to discuss with an accountant before making a decision.

Finding an accountant

Mettle connects with key accounting software providers such as Xero and FreeAgent, but you can also export your transactions and receipts to CSV files. Some customers find that working with accounting software or managing their records themselves works.

You may find having the support of an accountant really helpful, particularly if you make a lot of transactions and plan to scale up quickly.

We hope that through Mettle all our customers will have a grasp on their finances, and be empowered to learn more about how their business is doing, with or without an accountant.

Choosing a banking provider

Ultimately if you’re setting up a business, regardless of what structure you choose, or whether you have an accountant, you’ll need a place to to get paid and manage your costs.

When looking for a banking provider, there are three key things to consider:

Quick and seamless account opening: our customers tell us they can’t justify waiting several weeks for their business account to be opened, or don’t have the time to meet in a branch face-to-face. Many challenger banks give sole traders and private limited companies the ability to open an account remotely. For more information about our account opening process, check out Simple and quick onboarding.

No hidden costs or transaction fees: as you’re starting out, the last thing you want to worry about is having additional outgoings. While some business accounts charge for accounts and transaction fees, we don’t.

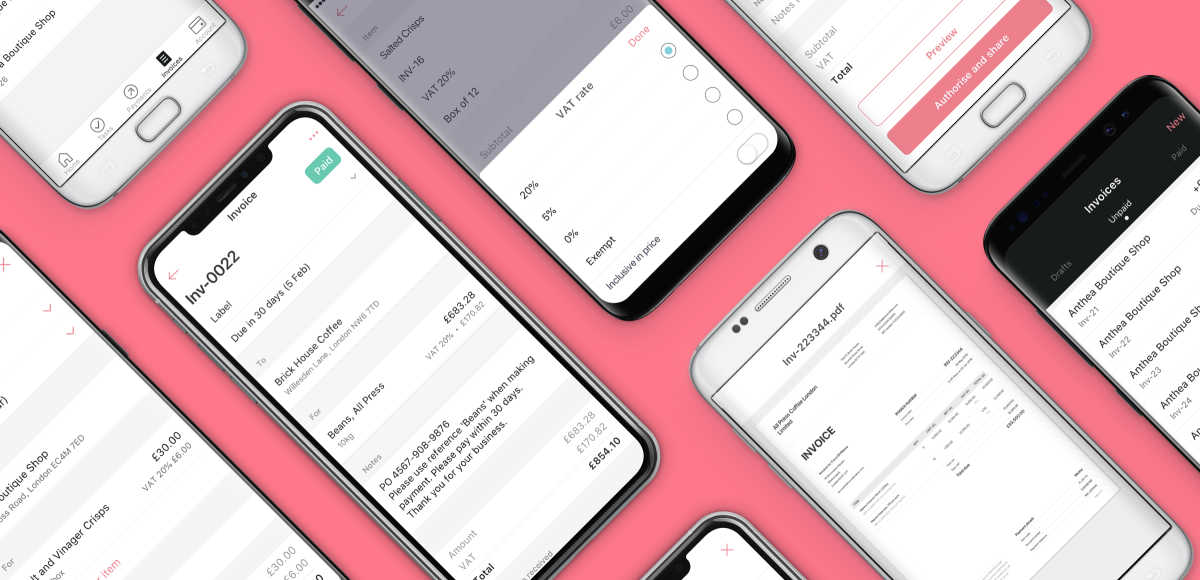

Bookkeeping and accounting integrations: our small business customers tell us they want to have tools to make doing their financials easier. This might include the ability to create invoices on the go, capture receipts and easily share data seamlessly with accountant or accounting provider, ready to do their books and tax returns.

Ultimately there's many different options available to you, whether that’s in setting up your business, engaging an accountant or selecting a banking provider. These tend to be based on your size, type of business and ambition.

Interested in finding out more about Mettle? Check out our eligibility page.