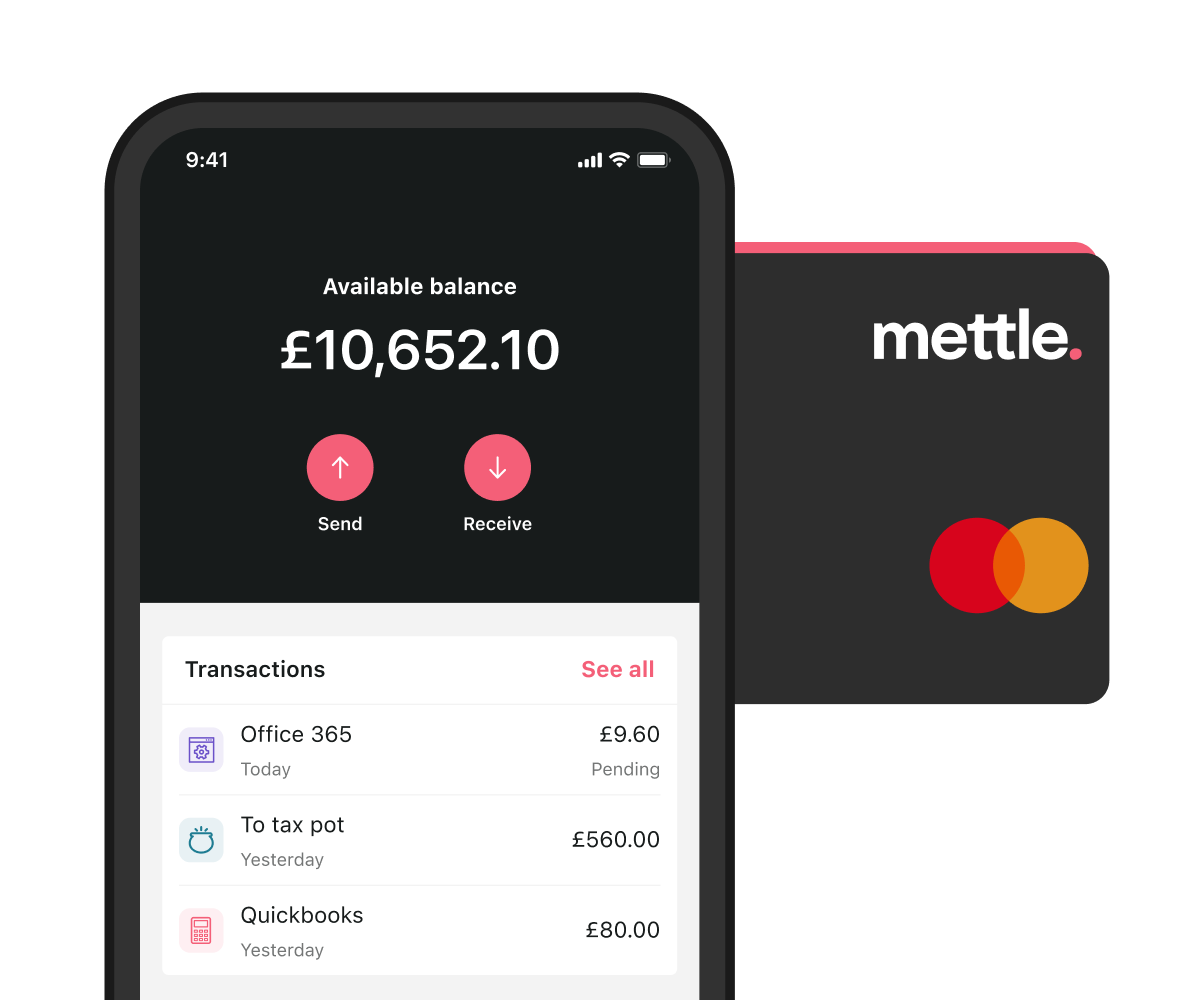

The business bank account built for the self-employed

What is Mettle?

Mettle is a mobile-based business account, backed by NatWest.

We provide small business owners with features to manage their business finances on the go.

Our features

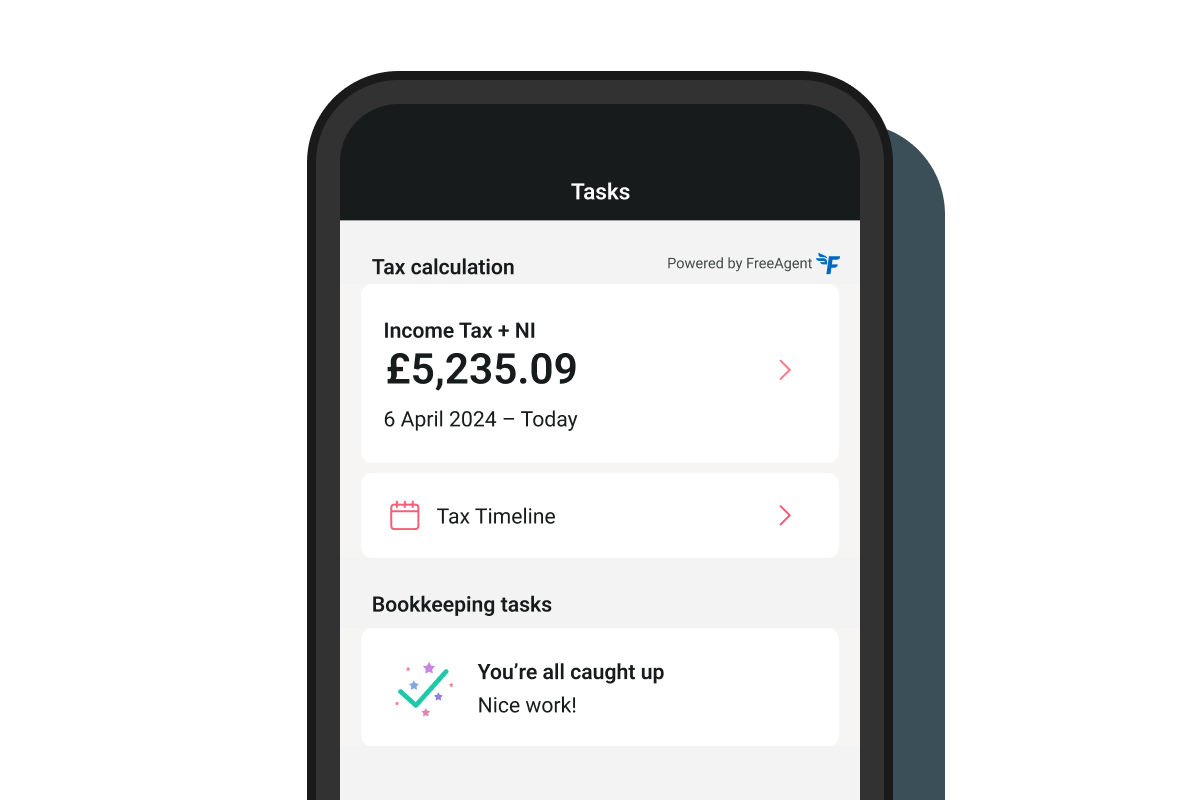

Be tax confident

Keep track of how much tax you’re likely to owe by using our tax calculation*, backed by FreeAgent, so there are no surprises.

Get FreeAgent included

Connect FreeAgent accounting software with your Mettle account to get a complete view of your finances and manage your tax obligations.**

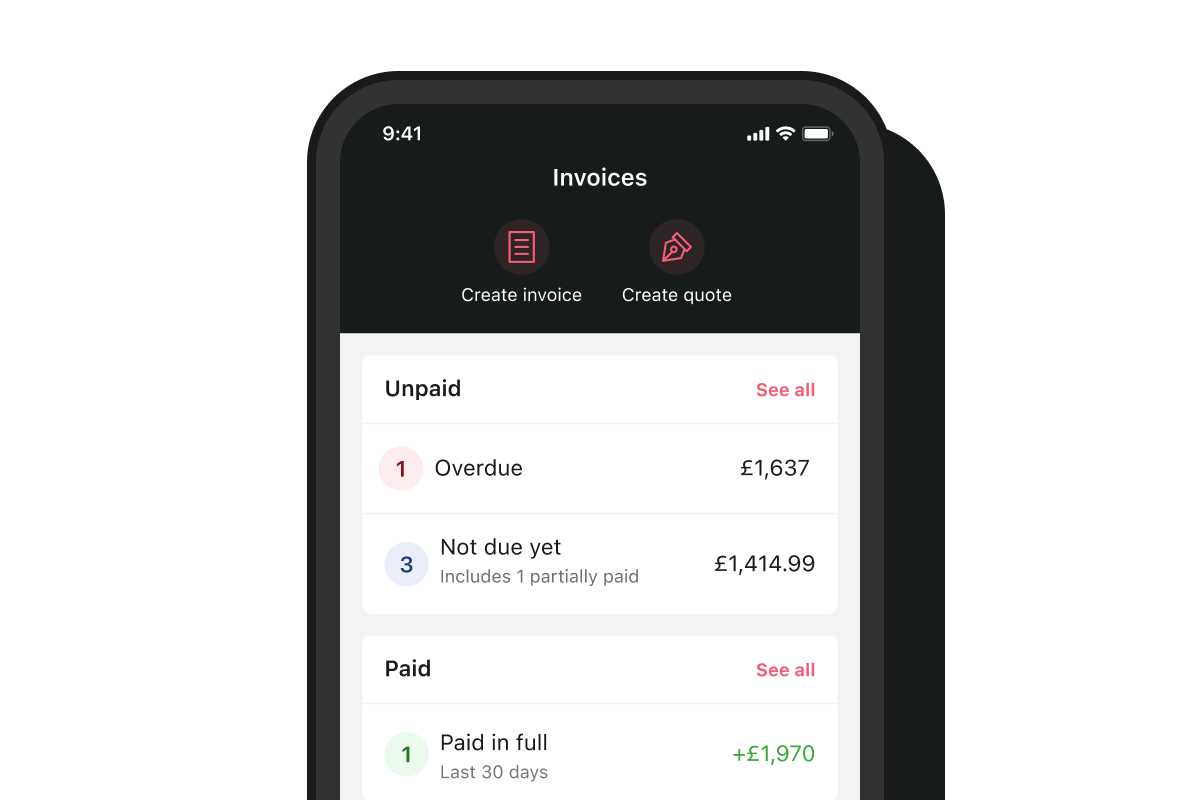

Get paid faster

Get an overview of the money coming in, the status of your invoices and chase payments with automated reminders.

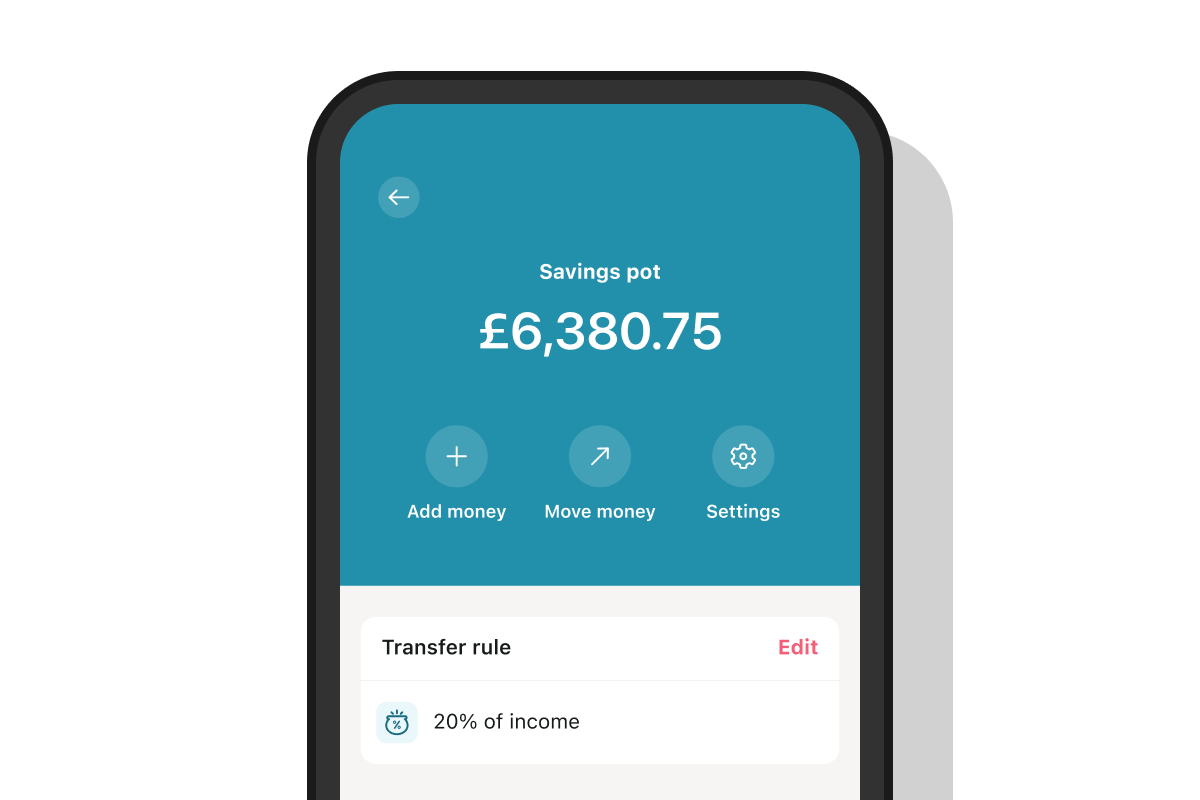

Save for the future

Use Pots to automatically set aside a percentage of your income or schedule a regular amount to save.

Or boost your money with an interest bearing Savings pot***.

***Only savings pots can earn interest. You can only have one savings pot. It has a maximum balance of £1m. The interest rates may change to reflect the savings market. Interest is calculated daily and will be paid out monthly. Any positive change in interest will be notified within 30 days, any negative change in interest will be notified at least 60 days before. Read the full Mettle business account T&Cs here.

New: Mettle+ could help you win more business

Just met a new client? You can now create and send quotes on the go and convert them to invoices in-app for £4 a month.

Mettle+ is an optional paid-for feature. You can cancel at any time. You'll need to be a Mettle customer to access Mettle+ which you can sign up for directly in the Mettle app.

Key considerations

- You must be a sole trader or limited company with up to two owners

- You must be a UK-based company with owners who are UK tax residents

- You can't exceed your main account balance limit of £1 million

- You can’t deposit or pay with cheques

- We don’t provide overdrafts for our accounts

- We don’t offer government backed loans

By NatWest

Have confidence knowing we're part of a trusted and regulated bank

Help from real people

Our team is here to support you whenever you need it

Safe and secure

Eligible funds protected up to £85,000 by the Financial Services Compensation Scheme (FSCS)

Mettle can close your account if you behave in an offensive, threatening or violent manner, which includes any racist or other discriminatory conduct, towards staff. See the T&Cs for more information.

Frequently asked questions

Is Mettle free?

You can open a Mettle account for free and we don't charge any transaction fees. There are optional paid-for features in app as part of our Mettle+ subscription.

Can I add cash to my account?

Are there account limits?

Yes, there are limits on your account balance. Your main account balance limit is £1 million for both sole traders and limited companies. This is in addition to a further £1 million you can hold in a savings pot and £100k across your regular pots. This is a total of £2.1 million.

Read moreHow is my money protected?

The Mettle bank account is provided by National Westminster Bank plc trading as Mettle. Eligible customer deposits held with National Westminster Bank plc are protected under the UK’s deposit guarantee scheme, the Financial Services Compensation Scheme (FSCS).

Read moreDeposit protection means that if an eligible customer's bank fails or it is likely to fail, the FSCS will automatically pay an eligible customer the value of their deposit up to the deposit protection limit. The deposit protection limit is £85k per eligible customer, per eligible bank. This means the limit applies to all the accounts an eligible customer has with a bank and not to each account the customer has with that bank.

Find out more at on our FAQs page.

Is this a NatWest account?

Mettle is part of the NatWest Group. The Mettle bank account is a NatWest bank account. However, although Mettle operates as a brand of NatWest, you won't be able to access NatWest products or services with your Mettle account.

How do I contact your support team?

The best way to contact us is through our in-app chat. Just tap 'Get help' on the Account tab and one of our team will be happy to help.

Read moreAlternatively, you can email us on support@mettle.co.uk or call 0800 0987 765. For anything press related please contact: press@mettle.co.uk. Our support hours: Monday – Friday 8am to 8pm Saturday and Sunday (and Bank Holidays) 9am to 5pm